cash flow return on assets formula

The term ROA stands for R eturn o n A ssets and is a commonly used metric for tracking how efficiently a company can put its assets to use to produce more net profits. What is a good cash flow to sales ratio.

Internal Rate Of Return And Time Weighted Return In 2022 Financial Analysis Portfolio Management Financial Management

The cash return on assets ratio of 10 might be high in one industry but very low in another.

. It indicates how effective a company is at turning capital into profits. Cash flow from operations. The measure is usually derived in aggregate for an entire business in which case the calculation is to divide the total average assets into the cash flow from operations.

The statement of cash flows showed EBIT of 64000000. The following formula is used to calculate it. Cash on cash return is a rate of return ratio that calculates the total cash earned on the total cash invested.

Cash flow coverage ratio 80000000 38000000 2105. The formula for the cash return on assets ratio requires two variables. Cash Flow to Sales Ratio Operating Cash Flow Net Sales.

Cash Return on Assets basically shows how well or how poorly the company is generating cash from its asset investments. Is the net cash flow from operating activities in the statement of cash flow. However the higher the percentage the better.

Receive the financing and support you need to reach your business goals. Example The cash flow to total asset ratio is most often used by company management to estimate when cash will be available and how much cash will be available for future operations. The more value that a company can extract from the assets on its balance sheet the more efficient the company operates since its assets are being utilized at.

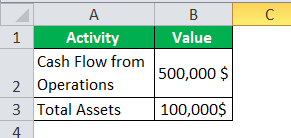

C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s. Cash Flow on Total Assets Ratio Formula. Cash flow return on investment can be compared with the hurdle rate which is referred to the sum of capital that is calculated by adding up the cost of debt financing and return on the equity of the investment.

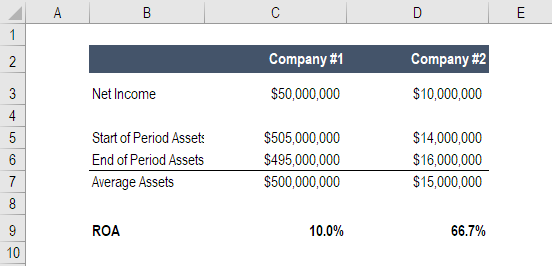

Return on Assets ROA Definition. Similar to Return on Total Assets the company hopes to generate as much revenue as possible from its assets. The Cash Return on Assets measures the Cash Flow from Operations in relation to Total Assets.

Cash on cash return is a simple financial metric that allows the assessment of cash flows from a companys income-generating assets. CFROI Cash Flow Market Value of Capital Employed. The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets.

The formula is as follows. Operational cash flow and average value of all assets. Cash flow from operations Total average assets Cash return on assets.

Return on capital ROC or return on invested capital ROIC is a ratio used in finance valuation and accounting as a measure of the profitability and value-creating potential of companies relative to the amount of capital invested by shareholders and other debtholders. Ad Get the cash flow your company needs by leveraging your AR and other business assets. Cash Flow Return on Investment is calculated using the formula given below CFROI Operating Cash Flow Total Assets Total Current Liabilities.

A cash flow to sales ratio is considered good if it falls between 10 and 55. The amount of the total cash earned is generally based on the annual pre-tax cash flow. Expected Return WA x RA WB x RB WC x RC where.

The equation is as follows. Here is the expected return formula with the scenario that your portfolio holds three assets. To calculate the cash flow return on sales we must first convert the net income figure into an approximation of cash flows by adding back non-cash expenses though this does not factor in changes in working capital or fixed assets and divide by net sales for the measurement period.

Net asset value NAV is the value of an asset minus the. The ratio is calculated by dividing the after. The formula for calculating the Cash Flow to Sales Ratio is.

The cash return on assets ratio varies by industry. In the calculation the cash flow from operations figure comes from the statement of cash. Net profit Non-cash expenses Total net sales.

How can cash flow to sales ratio be improved. Depreciation of 4000000 and amortization of 8000000. Additionally a more conservative approach is used to verify so the credit analysts calculate again using EBIT along with depreciation and amortization.

Return On Assets Roa Double Entry Bookkeeping

Return On Assets Roa Formula Calculation And Examples

How To Invest Rs 10 000 In India For High Returns Investing Books Value Investing Investing

10 Must Read Books For Stock Market Investors In India Trade Brains In 2022 Investing Books Personal Finance Books Investing

Return On Assets Roa Formula And Excel Calculator

Financial Ratios And Formulas For Analysis Financial Ratio Financial Statement Analysis Accounting Education

Audited And Unaudited Company Financial Statements Company Financials Financial Statement Cash Flow Statement

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Financial Ratios And Formulas For Analysis Financial Ratio Financial Statement Analysis Financial Analysis

Best Practices For Implementing Oracle Fusion Erp Analytics Key Performance Indicators Analytics Chart Of Accounts

What Does Price To Cash Flow Indicate Positive Cash Flow Cash Flow Financial Analysis

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow From Operations Ratio Formula Examples

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

What Is Capital Structure And Why It Matters In Business Fourweekmba Cash Flow Statement What Is Capital Value Investing

Cash Flow Dashboard Template Excel Dashboard Templates Dashboard Template Financial Dashboard

Cash Flow From Operations Ratio Formula Examples

Pin On Fundamental Analysis Of Stocks

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Accounting Education